Propane Futures Contracts: A Mont Belvieu and ARA Comparison

Navigating the world of propane futures contracts can feel daunting, especially when comparing the major trading hubs: Mont Belvieu, Texas, and the ARA (Amsterdam-Rotterdam-Antwerp) region in Europe. This guide will clarify the key distinctions, empowering you to make informed decisions regardless of your experience level in financial markets. Understanding these differences is crucial for anyone involved in propane buying, selling, or hedging.

Understanding the Two Main Propane Markets

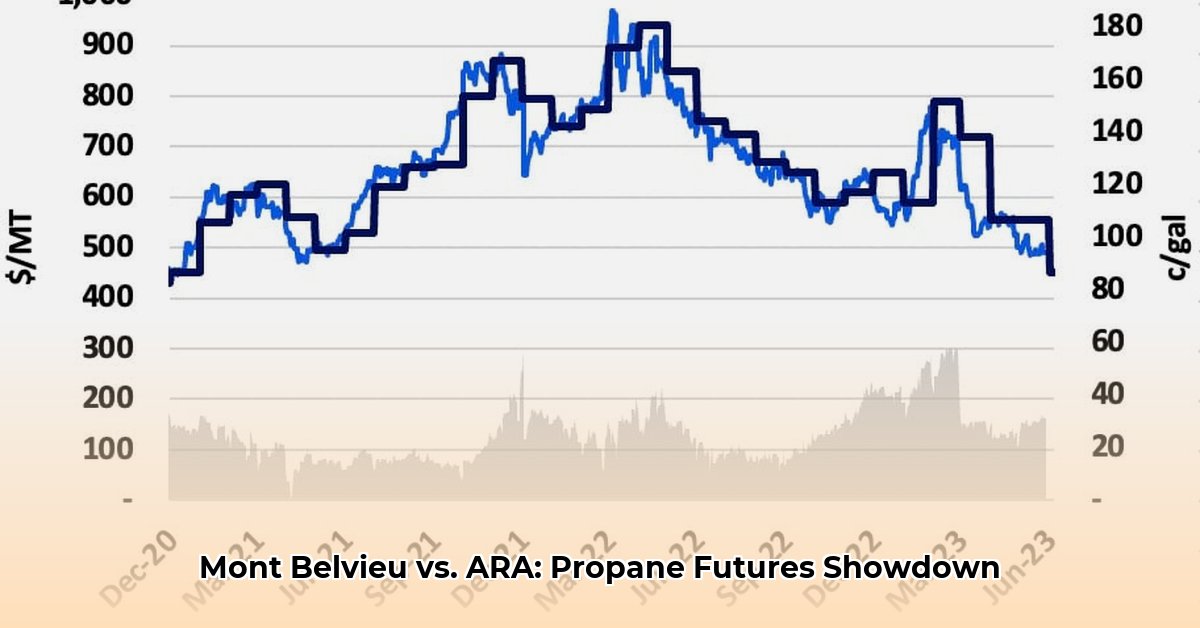

Mont Belvieu serves as the North American propane market's epicenter, while ARA is the European counterpart. Most US propane futures contracts, traded on the CME Group, utilize Mont Belvieu as their benchmark due to its significant physical delivery and trading volume. Conversely, European propane futures contracts, primarily traded on ICE Futures Europe, use the ARA region's price, calculated by Argus Media, as their benchmark. The core difference lies in geographic location and market structure. Think of them as two distinct, yet interconnected, marketplaces. How do these differences impact your trading strategies?

Key Differences: Market Liquidity

A significant distinction lies in market liquidity—how easily contracts can be bought and sold. The Mont Belvieu market, utilizing the CME Globex electronic platform, boasts high liquidity and rapid price changes. Trades occur frequently, reflecting a dynamic market. In contrast, the ARA market, while significant, operates at a slower pace. It settles monthly based on Argus's average daily price, resulting in less real-time price fluctuation. This creates a more measured trading environment. Does this difference influence your risk tolerance?

Basis Risk: Understanding the Price Gap

Basis risk, the discrepancy between the futures contract price and the actual price at a specific location, is a critical concept. Because Mont Belvieu prices reflect the US market and ARA reflects Europe, inherent basis risk exists for cross-regional traders. The price difference mirrors the gasoline price variation between California and New York. Careful monitoring of this difference is vital for risk management. How can you effectively hedge against basis risk?

Choosing the Right Propane Futures Contract

The optimal market choice depends entirely on your unique circumstances. Are you a Texas-based propane producer? A European consumer? A global trader? Your location and objectives heavily influence your decision.

| Stakeholder | Mont Belvieu (US) | ARA (Europe) |

|---|---|---|

| US Propane Producers | Excellent Fit | Likely Not a Good Fit |

| European Propane Consumers | Probably Not a Good Fit | Excellent Fit |

| Global Energy Traders | A Potential Opportunity | A Potential Opportunity |

Assessing the Risks

Each market presents specific risks. This summary outlines potential challenges for both Mont Belvieu and ARA propane futures contracts:

| Risk Factor | Mont Belvieu | ARA | Ways to Reduce Risk |

|---|---|---|---|

| Price Swings (Volatility) | Moderate | Moderate | Diversify investments; utilize options contracts. |

| Basis Risk | Relatively Low | Relatively High | Closely monitor; employ location-specific hedging. |

| Liquidity Issues | Less of a Concern | More of a Concern | Diversify across contract months. |

| Regulatory Changes | Moderate | Moderate | Stay updated on regulatory developments. |

| Counterparty Risk | Low | Low | Utilize reputable clearinghouses (CME or ICE Clear Europe). |

How to Mitigate Basis Risk in Propane Futures Trading Between Mont Belvieu and ARA

Key Takeaways:

- Basis risk significantly impacts propane traders' profitability.

- Effective hedging is crucial for managing volatility.

- A combined approach utilizing financial tools and operational adjustments is essential.

- Understanding ratable vs. non-ratable pre-buys is vital for strategy development.

- Tailoring strategies to short-term and long-term horizons maximizes effectiveness.

Hedging Strategies: Tools for Success

Several tools help mitigate basis risk:

Financial Instruments: Swaps offer price protection, acting like insurance. Pre-buys secure propane at a fixed price; however, understand the distinction between ratable (flexible) and non-ratable (less flexible) pre-buys. Combining these instruments strengthens the hedge.

Operational Strategies: Supply diversification reduces reliance on single regions. Robust market intelligence enables timely price fluctuation adjustments. Strong cash flow management safeguards against unexpected price swings.

Short-Term vs. Long-Term Strategies

Your approach varies depending on your timeframe:

Short-Term (0-1 Year): Tactical hedging, swaps/pre-buys to cover a significant portion of winter volume (40-60%), consistent market monitoring, and maintaining a strong cash position.

Long-Term (3-5 Years): Sophisticated risk models incorporating weather patterns and global events, long-term supplier contracts, infrastructure investments in supply chain enhancement, and evaluation of new technologies for improved efficiency.

A Risk Assessment Matrix

| Strategy | Risk Level | Mitigation |

|---|---|---|

| Swaps | Medium | Diversify providers; monitor market trends. |

| Ratable Pre-buys | Medium | Assess volume needs; monitor the market. |

| Non-Ratable Pre-buys | Medium | Assess flexibility needs; combine with swaps. |

| Physicals | Medium | Evaluate bid/offer spreads; use for short-term needs. |

| Supply Diversification | Low | Monitor supplier reliability and geographic spread. |

| Enhanced Market Intelligence | Low | Invest in reliable data and forecasting tools. |

Navigating Regulatory Changes

Stay informed about evolving regulations in energy trading, environmental concerns, and transportation rules, as they significantly influence propane prices. Adapt your hedging strategies accordingly.